|

Never lunch alone.

Yesterday there was a post in here about what kind of foods should never be brought into a break room in the office for lunch. I stated on the post that you shouldn't be bringing lunch. You should be making it a point to be taking someone to lunch each day. A referral partner, someone involved with investment properties, a local business owner, SOMEONE that has the ability to turn business over to you either ongoing or someone that has an elephant for you to land. An agent mentioned that this was a waste of money. $15 a day to buy another person lunch is $300 a month. That money could be going to marketing was the reason to not take someone to lunch. My friends... If $15 is too much for you to sit down with a person to build an actual relationship, actual rapport, and to start an actual client/ advisor relationship, I do not know where else to go with my advice. We are in a relationship business and we spend our days trying to run away from, avoid, and duck relationships. We want automation, staff, and technology to do everything. $300 a month to have 20 real conversations a month. If 60% let you quote them, you quote 12. If you close 50% as a captive you closed 6 deals from it. These should be closing at a rate of at least 50% as you are choosing who to lunch with and should know who your ideal prospects are or at least what they look like from 10,000 feet. 6 deals on just a normal household at 2.5 products per household = 15 new policies. 15 new policies x 12 months = 180 policies a year. 180 policies @ $1000 in premium per policy = $180,000 in premium... for eating... which you are doing regardless.. $180k @ 12.5% (using that as an average of captive and independent commissions) = $22,500 - YEAR 1. I think we get residuals in this business too. I heard that somewhere. $300 a month ($15 a day to buy someone elses lunch) X 12 months is $3600 in marketing dollars. You are cash positive $18,900 your first year. You made a 625% return on investment your first year. And that is from taking 1 person to lunch a day. Getting 60% of them to let you quote and closing 50% of those people. 20 lunches. 12 households to quote. 6 new households per month. And thats if you are only taking out personal lines prospects. If you are taking out referral partners you are trying to land, investors, business owners... Never lunch alone my friends. Your lunch dollars ARE marketing dollars. If you understand the game.

0 Comments

This piece originally ran on InsuranceJournal.com.

The effects of the COVID-19 pandemic will be felt by the insurance industry and its customers well into 2021 as consumers and businesses continue to face economic challenges, according to a new survey by consumer credit reporting firm TransUnion. Insurance customers will also expect insurers to offer digital tools that make it easier to conduct business. “The unpredictable environment that lies ahead indicates consumers and businesses will increasingly rely on and choose insurers offering online resources and tools that can best meet their needs, particularly as digital adoption continues to grow,” said Mark McElroy, executive vice president and head of TransUnion’s insurance business. TransUnion conducted the survey of 3,148 U.S. consumers with active auto, homeowners, renters and/or life insurance policies during the first week of December. In their analysis of the findings, TransUnion researchers identified several trends they believe the insurance industry can expect to see play out during 2021. Three Trends to Watch Trend #1: The financial and economic challenges brought forth by COVID-19 will continue to impact consumers and businesses, potentially leading to profitability impacts for insurance carriers down the road. Looking at the next three months ahead, TransUnion’s consumer survey indicates respondents are primarily concerned about being able to pay for their auto insurance bill (44%), followed by their car payment (26%), mortgage payment (23%) and life insurance bill (22%). A recent TransUnion analysis also noted an increase in the distribution of higher risk auto insurance shoppers as well as those with payment accommodations in 2020. Factors such as rising unemployment and varying financial impacts may be contributing to this trend, and it will be imperative for insurers to be able to identify which customers are facing COVID-19 hardship to strengthen engagement. Within the commercial automotive space, TransUnion has observed that many insurers are experiencing relative stability in underwriting performance in the short-term resulting from fewer claims on less congested roads and less miles driven, among other confluent factors. As the broader environment begins to normalize, insurers will again need to implement strategies that help them increase segmentation and remain competitive in the wake of COVID-19. Trend #2: Consumers and businesses expect insurers to have a greater understanding of their individualized needs in light of shifting behaviors and preferences. For respondents who own or lease a car (90%), TransUnion’s survey indicated that 72% used their vehicle less in the time since COVID-19 was named a global pandemic or don’t use their vehicle anymore. Given this drop, there may be greater consumer interest in usage-based insurance and telematics programs. The survey found 61% of drivers would allow their insurance carrier to collect real-time information about their mileage and driving habits if it could lower their premium. Looking at the commercial and personal property space, respondents expressed a strong preference for at-home settings when asked to choose their preferred work environment for 2021 – 37% of respondents cited a preference to work at-home, and 31% preferred a hybrid of working in-person and at-home, with more time spent working from home. These findings may signal less demand for commercial real estate as well as broader shifts within the commercial and personal space as employers extend work-from-home policies or adopt hybrid work environments to best address employee needs and operational demands. Trend #3: Insurance digitization efforts will continue to strengthen in 2021. Digital adoption in the insurance industry grew 20% globally in the past year. This transformation is taking place across the insurance policy lifecycle, from marketing to claims submissions to digital policy servicing. TransUnion’s survey found that almost half of respondents (47%) filed an auto and/or property claim in the last year, and of those, nearly four in 10 (39%) used a mobile app, website portal or e-mail. Consumer preferences for interacting via digital/online platforms also support this trend. The survey found respondents preferred to communicate with an insurance provider primarily via e-mail (32%) and telephone calls (32%), followed by an insurer mobile app or website portal (18%). As digitization grows, insurers must balance introducing and expanding digital customer interactions while also delivering friction-right experiences and protecting against fraud. Hey guys, Katey here. Insurance Soup's resident content creator. I wanted to drop a quick note in here to just say how easy it has been working with Taylor and Mike when it comes to creating meaningful, heartfelt, and inspiring content for Insurance Soup and its members and what you're about to read is exactly all of those things.

In 2019 Taylor bared his soul for you all when he posted the following in the group. Mike does the same regularly. I've not been in the presence of such openness from business owners, especially when it solely comes from their desire to help others succeed. Below you'll read Taylor's reflections on one of the hardest struggles of his life and his advice on helping yourself through the same turmoil. Hoping this strikes a cord with anyone who reads it. "Lets talk about anxiety. For me, this goes back to my childhood. Most do not know but I started school when I was 3 years old because I had a severe speech impediment. Besides my own mother, no one could understand me. I spent 7 years twice a day on speech therapy. Growing up, I got made fun of and mocked which caused me to have anxiety anytime I had to speak or read in front of people. On days when I knew I would have to read in front of the class, I wanted to skip school all together or crawl into a hole. I hated it. I remember the first speech I had to give Sophomore year in high school. I felt physically sick. The closer I got to it being my turn I started sweating and shaking. I felt like I was going to be judged and that my friends would make fun of me. When the teacher called my name to go up to the podium, I froze. I didn't want to move. That 3 minutes felt like 3 hours. Fast forward to my senior year. The struggle was still there but my confidence had grown. My english papers would look like the teachers pen literally exploded due to all the spelling and grammar mistakes. The only thing I ever seemed to get right was my name at the top of the paper that guaranteed me a 15. After that, it was a crap shoot. My senior English teacher looked me straight in the eyes one day in front of the entire class and told me that I wouldn't ever be successful because I couldn't follow directions or apply myself. That lit a fire deep down that still motivates me to this day. There are a lot of things you can do to cure anxiety but only one thing has ever seemed to work for me. It's not medication. It's not talking about it. It's not listening to a "magic" podcast. Its taking action against it. ACTION CURES ANXIETY When I got into sales and had to cold call, I would sit there and get nervous until I made that first call. When I would go meet a large commercial prospect, I would get nervous until I sat down in front of them. It's no different than when we first started dating. You would see that girl/guy you wanted to go talk to, but you'd just sit there and try to play out how it would go because you didn't want to look like an idiot. And most the time, you probably talked yourself out of going over there at all. Sales is the same exact thing. Except there's a payday at the end of each date. When you start to feel that anxiety creep in, take action right away. Pick up the phone. Walk into that meeting. Go talk to that mega lender or real estate agent. I can assure you the only thing that cures that anxiety you are feeling is the action you take against it." We're halfway into 2021 and most agents have burst out of the gate in hopes of making up for any leftover lost time from the crazy year we called 2020. And while an eagerness to catch up and make things whole after a year of so much uncertainty is a good thing, sometimes we can lose important elements of our sales, marketing and customer service strategies along the way.

Below is a short list of common things that agents do to turn customers and prospects off without even knowing they're doing it. YOU'RE COMING IN TOO HOT Confidence is always key when it comes to selling but there's a fine line between confidence and cockiness, and we all know that cockiness is a killer. You probably aren't even aware that your selling tactics are a little on the aggressive side and you're coming on too strong in your quest to hear YES. Remember the basics of selling and ask the right questions so that you can let the client accurately tell you what they need instead of you taking the lead and bulldozing them into something they've got no motivation to buy. YOU'RE NOT FOLLOWING UP In your desire to close as much as you can, you're not taking the time to go back to clients you've already met with to follow up. You might be so busy reaching out to new prospects and stepping out to network or take meetings with new clients, you're forgetting to circle back on the hard work you've already put in. Your customers and potential clients want to know that their agent is present and will be accessible in every stage of the agent-client relationship, making this a crucial step that will lose you business if not done consistently as a rule. YOU'RE NOT STAYING EDUCATED Once agents have received all of the necessary licenses and jumped through all of the required hoops that make them eligible to sell in their state, their focus, naturally, becomes selling. Something that commonly goes overlooked is the agent's continuing education. This industry is one that's always changing and there is always more to learn. Going to a client as anything other than an expert on everything that you sell AND BEYOND will hurt you in the long run. Staying on top of your products and the products available to clients that you do not offer could be disastrous to your agency. YOU'RE FUMBLING CLAIMS When a client has to file a claim, it becomes showtime for the agent. You've sold a policy as a safety umbrella and now the client needs you to come through and take care of them in their time of need. Beyond being present for your client throughout the entire claims process, you've got to do your best for them on the carrier side as well. If a client has a poor experience with you this will be indirect opposition to what you've promised them and could be a big problem for your agency in terms of potential public reviews and referrals going forward. No one is perfect and if you're being authentic with clients, you should have no problem admitting when you've made a mistake and doing all that you can to make it right. Some mistakes aren't as obvious as others, but if you do all that you can to stay true to your word and always do your best to service your clients as you'd be serviced, you should find yourself staying ahead of the game. Great piece below posted by Mike in Insurance Soup back in 2019. I'm posting it to the blog now, in 2021 because of the everyday relevance it has to insurance agents and to anyone determined to make it.

"Long read even for me. It’s worth it. I want to tell you a story I’ve sat on for a while. It’s the first time I’m publicly sharing it. It’s a story I was ashamed of but in hindsight has taught me a very valuable lesson. When I began in this industry I had a year to prove my worth to earn my contract. Every quarter the carrier leadership would check in and let us know “how I was doing” in their eyes. Every quarter I was told I was doing poorly. I was top 3 in all product lines but 1 in my district and I was scratch having my stats compared to agencies that were padding theirs with rewrites and renters that move and need new policies every year. I was 2nd in homeowners despite only being allowed to write 3 a month on Long Island. I marketed north of the city. I was told I wasn’t writing enough life insurance. But I had no local homeowners and renters were a tough close. I started selling auto insurance in Queens and Brooklyn where the premium was so high the discount for life insurance lowered their auto and gave them life for free. I was told I wasn’t writing enough auto loans so I started generating leads for a local used car lot who started using me for their loans. I was told that I (ME!) lacked vision and entrepreneurial spirit and creativity. I was put through the wringer for a year. I cried in the parking lot of my Agency after a conversation with my “leadership” left me feeling like I wasn't earning my contract. I finally had enough one day and called up my leadership and said "Can you explain to me why you are harassing me while I’m top 3 in all lines but 1?" We went back and forth and I demanded her production numbers from when she was an Agent. Had to be a pretty big hitter to be busting my balls when I’m doing well and putting in 6 days a week, 12-14 hour days and half day Saturdays. Hell, I was so rattled that summer I worked Sundays too. Let's just say that asking for production numbers killed the conversation quickly. And then one December morning with just days left before my contract renewed... or denied...after asking for weeks for a heads up because I have staff and a lease I got a phone call saying I got my contract. A contract I no longer personally wanted as I hated my carrier and leadership for the year of hazing they put me through... hiding that I wouldn’t be able to write homeowners from me until after I opened... pushing me to sell life to people who didn’t need it or want it... and hanging compliance over my head, not allowing me to market the way I knew people were killing it. I went on for another 2 years hating it and hating my carrier leadership. Ultimately I left knowing that I didn’t own my book and here I am fighting to build a book without the ability to sell a marquee product and being pushed to sell another product to a niche that didn’t really want or need it just to hit numbers. I smiled when I saw leadership. Shook their hands. But the way I was treated and spoken to that first year put a fire in my belly. A fire that was lit by my leadership and that burned hotter and brighter with each new agent I spoke to going through the exact same thing. Agent in Pittsburgh tops in a bunch of lines in her area being told she sucks. Agent in Vermont doing very well actually NOT get their contract because of some arbitrary skill they said he didn’t have. Agent in the Bronx dealing with another Agent stopping by his office and trying to poach employees and telling clients my buddy was new and didn’t know what he was doing... carrier did nothing. The stories I had my first year as agency owner transformed me from a fresh faced starry eyed kid who thought he just landed his dream gig into a crusader for the industry out to smash corporate in the mouth and smash it for all it stands for. I was a loser by their definition. It made me begin to think I was a loser BY DEFINITION. And I knew I wasn’t. I knew my numbers. I knew my career leading up till now. I’m a banger. I'm a scrapper. I’m always near or at the top. That experience nearly broke me but it didn’t. It spit me out as someone who decided to challenge the industry and fight for Agents and ruffle feathers at carriers and teach Agents how to be themselves and ignore the whimpering monkeys and their demand for bananas while still performing at a high level. My point is this: this industry is ugly and there are just as many if not more people trying to tear you down than build you up. Don’t listen to any of them. Their voices can get in your head and you can start believing them. So here I stand before you today, an Agent with no vision, no creativity, and no entrepreneurial spirit who, just a short time later in the grand scheme of things, owns 6 businesses in this industry. Most are or were new ideas when we started them. With 38,000 strong in Insurance Soup on Facebook. Having more solutions on the way. Speaking at conference after conference alongside names such as Gary V, Cardone, and most recently now, Jeffrey Gitomer. Know your worth. Don’t let anyone else tell you. They don’t know. Go for yours and don’t stop until you get it. Quit and prove them right. Listen to them and they ARE right. Ignore them or use the words for fuel and never look back. You’re a winner whether the losers who got “promoted” to corporate realize it, acknowledge it, or not. Love, Your favorite “failed” Agent" This post originally ran on Insureon.com.

Being an insurance agent comes with its own set of risks, and errors and omissions claims can arise even from a simple mistake. It’s crucial that you provide the right insurance coverage for your clients, but it’s also equally important for you to have the appropriate small business insurance and E&O insurance policy for your agency. Take steps to protect your business from these six common causes of insurance agent errors and omissions claims: Failure to maintain appropriate coverageThe key to a client-agent relationship is the client’s trust that you will monitor insurance coverage and provide guidance to protect the client’s financial health. Still, there are circumstances when you might not procure the correct coverage. In that case, when a loss happens, the client would be responsible for financial damages. If the client feels you are at fault, she or he could take legal action. Cases like this comprise a substantial percentage of E&O claims against insurance agents. You can avoid a similar situation with the following steps:

FAILURE TO CORRECTLY EXPLAIN COVERAGE If you’ve followed the practices outlined above to ensure proper coverage, you are already on the right path to protect yourself from E&O claims. But there are a few other steps to make sure your clients are aware of all the factors that could affect coverage:

ADMINISTRATIVE ERRORS Mistakes happen, especially when you are working with different software programs for new policies, maintenance, and renewals. One way to minimize the risk of claims against insurance agents is to reduce the number of people who work with a client throughout the customer journey. Many of us know the old game “Telephone” – where information is passed by whispering in the ear of one person to the next. Inevitably, the message is distorted or it has changed by the time the last person receives it. The same concept can apply to client management. The more people involved in the flow of information about a client, the greater the risk of communication errors. Assign agents to specific clients and have them handle every part of the process, from initial consult to purchase and ongoing maintenance. It’s important for an agent to keep agency staff up to date on the policies they sell. Professional development opportunities, such as continuing education classes offered by companies like WebCE and Noble Continuing Education, can help agents stay informed and educated about existing and new insurance products. All agents must fully understand the specifics of a product to communicate clearly with a client. FAILURE TO IDENTIFY EXPOSURES E&O lawsuits against agents often stem from poor risk analysis. This issue indicates that producers need further education. Protect your agents and your agency by:

FAILURE TO SHARE POLICY CHANGES If there is a change in policy coverage, the agent has a duty to share that information with the client. This could encompass any number of changes – from notice of renewal to a change in the insurer’s financial condition that would affect its ability to cover a claim or maintain the policy. FAILURE TO SEND ACCURATE CLIENT INFORMATION TO AN INSURER Remember that there are three crucial funnels for information:

Set up a process to routinely do the following: Monitor claim activity. Agents should follow up with both clients and insurers when a claim is filed. Monitor your carriers’ loss ratios. Industry patterns can help you anticipate problems and necessary updates or changes. Communicate every claim to the insurer. If a client calls you first when a loss occurs, your most important job at that moment is to either advise the client to contact a claims manager or forward the claim information yourself. Regardless, follow the claim and make sure that it is handled swiftly and appropriately. By keeping these concepts top of mind as you build and maintain your client relationships, you not only can provide excellent service but also mitigate your own risk of insurance agency claims. We know it's not Halloween, but we believe that there's never a wrong time for a cautionary tale when it comes to running your business and your personal success. Yesterday someone in the Insurance Soup group on Facebook had asked for some CAC horror stories because all they read and hear about are the success stories.

Generally there are a few common "horror stories" that we have come across...

Nothing too out of the box there. NOW. The BIGGEST problem that we see in CAC is the one below and it happens to every Agent at some point. It's when that first campaign hits and they realize that they do not have the systems, hours, or manpower needed to handle the avalanche of opportunity that starts to flow. From that first campaign that hits, the Agent has an Aha moment. For some that moment comes 3 days in, for some 3 weeks in, for some 2 months in. The biggest problem they have in their Agency is figuring out how to manage all the opportunities. We are not a magic pill or a silver bullet and we have NEVER pretended to be or act like it. We are an education and a mastermind and your success will come hand in hand with your effort, the relationships you form, and the time you spend learning. You do not go to the gym for an evening and then pose in front of the mirror admiring your results. But know that if ANY program promises you manna from heaven with little to no work, you probably should take pause. Does every Agent that goes through CAC come out the other side a success? Nope. Why should they? Have you seen some of your peers? Do you think they could pull off being successful at ANYTHING? Half the carriers hand out appointments to pulses and it shows. So no, we can not put a guarantee of success on our product. Hell a lot of you that come to us can't look in the mirror and confidently say that your Agency will be successful and that's ENTIRELY on you. So how can our education, the one that YOU need to implement that, the one that THOUSANDS are having success with... be our fault when you don't or won't put in the work? We can't promise you that you will be successful with CAC. Most are. You'll find some complainers in the wilderness. We don't coddle. We don't let you know that your failing is ok. We don't tell you what you want to hear. We will call you on your bullshit when you say something isn't working and you've only completed 6% of the education. We don't always say things the sweetest. What I can promise you with CAC is that if you are looking to take control of your marketing, learn how to implement automation, increase your referral partner army, have an agent family that looks out for you, master social media, and more, there's not a better spot to learn it in the industry than with us. Hell most of the other people teaching right now are former clients of ours that charge MORE for far less education, far less support, and far less success. We're over 3000 clients into this... and most of them wind up cheerleaders, friends, and supporters. If you are on the quest to be self-sufficient, financially more efficient, and in total control with your marketing... and if you want to have fun while doing it, CAC is for you. Don't join looking for magic. Join looking to work. Know that you will get everything you invested in yourself for and more. For everyone, summer is a time to relax. Maybe your kids are off from school and it's the best opportunity for you and your family to get away for a bit. Or maybe you're just spending extra time at the beach or on the golf course because of the great weather. However you celebrate summer, if you're an insurance agent, it can become easy to let sales slip a bit in the months of June, July and August. Check out our tips below for staying on top of your business so that you're set up for success when the leaves start changing color in the fall.

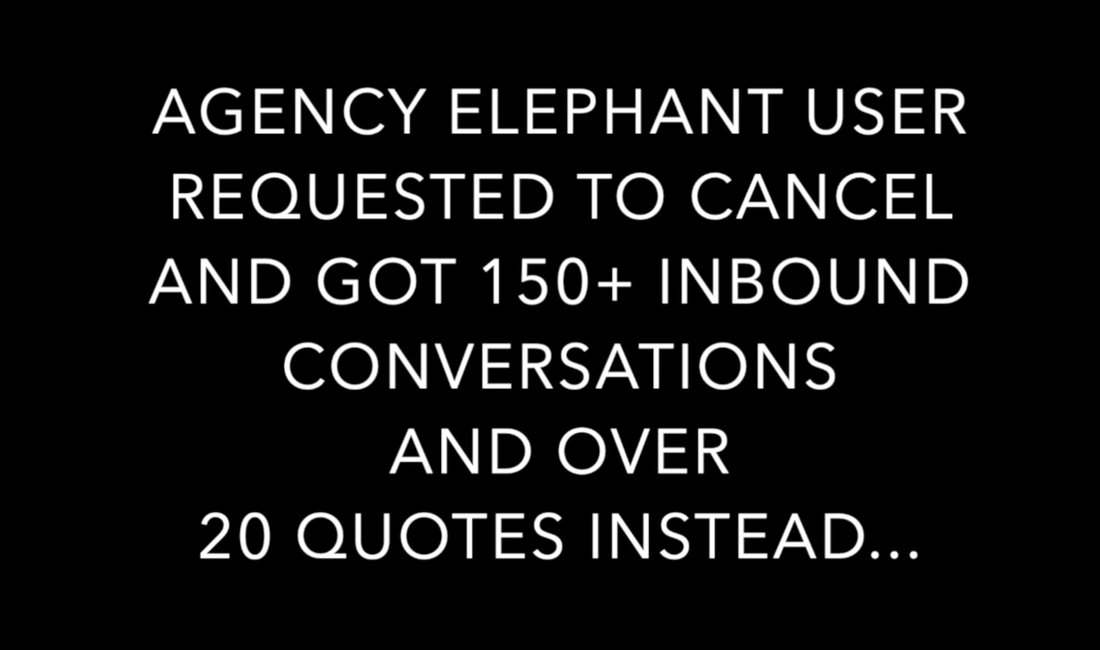

REACH OUT AND REVIEW Taking some time in the summer to get in touch with clients to discuss their existing policies is a great practice. You may find that lots of your clients are slowing down for the season and have some extra time to chat. You can check in to see if anything has changed which would require additional coverage and you can even cross sell if you see an opportunity to do so. This is a great way to stay on top of a client and let them know that you're looking out for them even when it seems things have slowed down everywhere else for the summer. DON'T WAIT... EDUCATE! Whether you attend educational workshops, seminars or virtual conferences or OFFER them, the summer is an excellent time for you and your staff to get your learn on. Choosing to spearhead and host a symposium related to insurance and/or anything your agency specializes in, is an important way to gain visibility for your agency and build credibility around yourself and your business. On the flip side, seeking out and getting involved in any kind of offered continuing education is a great way to capitalize on any free time that you may have. SWITCH UP YOUR CUSTOMER BASE You may have it made in the shade when it comes to your already-established customer base and if you do, then there's no harm in exploring a new one. There's a chance you could strike out by reaching out to a new audience, but you don't know until you try. Purchase some new leads in a new demographic and you just might surprise yourself. RECONNECT WITH YOUR TEAM The summer months are a particularly excellent time to casually catch up with staff. Maybe invite your producers in for a meeting and center it around an event that the entire staff can enjoy together. Maybe a concert, a long dinner out or a company picnic. It's a good time for you to address key business points with the most important people in your agency - ALL OF THEM - while also showing them that you appreciate the hard work they do all year by giving back with a fun celebration of some sort. Lots of other people may tell you to work through your vacations, but insurance agents need breaks too! So we suggest trying out some of the tips suggested above to see if you can get ahead of the game while still taking in the joys of the summer season. Have fun! After a short lapse in using Agency Elephant's automation service, Mitch Torres made a call to Brian Blair and Matt Hahn to cancel his subscription. Sensing that Mitch was overwhelmed, Matt asked Mitch a few quick questions, and well, the outcome was pretty unbelievable. Watch the video of Mitch's full testimonial below to see what happened and click here to learn more about Agency Elephant. This post by Carrie Reynolds originally ran on the National Association of Professional Insurance Agents.

Branding is a common buzzword, but do you know what it really means? And why you should care? And why it’s the MOST critical piece of your marketing strategy? Let’s start with some definitions of branding. A brand’s job is to make you the first choice when a customer needs your product or service. Here’s another definition: Your brand helps establish why people should do business with you or pay attention to you versus someone else in your industry (do I have your attention yet?). Branding is critical to everything you do in your insurance agencyYou can quickly see that branding is the jumping off point for about everything you do in your business. From website design, marketing materials you distribute, interactions you have with customers, all the way to invoicing your clients — the brand you’ve established and communicate to others should be consistent throughout your organization. It’s critical to get it right from the beginning. Whatever your brand promises becomes the expectation. To build a successful brand, you MUST do two things:

Without these two things, you’ll end up a commodity in an already highly commoditized industry. And whether we consider insurance a commodity is irrelevant. This is already the consumer’s perception and we have to fight it every day. Building your brand will help beat this perception. Not only that, but insurance agencies face competition from many different sources — it’s not just the agency next door or even in the next town. It’s the direct writers, the banks and other complementary industries and even companies that aren’t insurance companies but still want to get in the game. Let’s face it — everyone wants to sell insurance. Your brand is one of the few things that will differentiate you from the competition. How you can create your insurance agency brand Part 1 Start by talking to your own customers. I know — sounds all too obvious right? But here’s the thing — your customers are a wealth of information. Ask them the following questions to begin to figure out your brand:

What if you have an existing brand? The exercise above taught me that the brand you have now doesn’t necessarily need to be scrapped. Instead it can become the things you do well — you just have to put it into words, educate your staff, and communicate that brand through your actions and marketing materials. And that’s the most important thing — you have to live your brand every day. Your staff must live it as well. It needs to become bigger than you, almost taking on a life of its own. Part 2 Talk to your staff. If you also gather your employees together to brainstorm what you do well and what differentiates you from your competition, you will get a very useful list. It takes the pressure off you to come up with everything (because we know how crucial time is to the time-strapped small business owner). And, employee contributions help establish buy-in of the brand. If they have “skin in the game,” it’s much easier to believe the message. I did this with my own staff and their input (along with customer input) became the basis of the “Galvez Guarantee,” our written promise as to expectations and duties to our customers. It’s on our website and given to all new customers. You need both parts because you and your staff are too close to the situation to make impartial decisions. A disinterested third party like your customers will keep you honest. Part 3 Give strong consideration to working with a graphic designer who can take the results of Part 1 and Part 2 and pull that into something that’s visual and tangible. I learned a long time ago that your greatest successes are achieved when you do the work you’re good at and outsource the rest. Working with a designer also allows for consistency across whatever platform you’re using. So no matter if it’s a letter, email, Facebook post or whatever medium you choose to share your message, your brand must look and feel the same every time. It broadcasts one clear message to customers and prospects and means you don’t have to recreate the wheel each time (i.e. saves you time). What is NOT a brand I see many insurance agencies loudly proclaim what they think is their brand. Unfortunately, it’s just a list of characteristics. Here’s some examples:

Let’s face it; consumers don’t care about the above facts unless they know how these facts benefit them. All marketing should answer the consumer’s fundamental question, “What’s In It For Me?” So instead of stating these facts, show how each benefit the consumer (and answer some of the fundamental questions posed earlier):

What we discovered for our own agencyAfter questioning our customers and talking with the staff, we discovered that the best brand for us centered on Family & Community — we are a family-based business and love to help other families. Our welcome emails also talk a lot about joining our insurance “family” and we are proud of our commitment to community service and projects that benefit the community. Corollary points of distinction include our ability to explain difficult insurance concepts in ways our customers can easily understand, our responsiveness and timeliness, our honesty and our ability to live up to our promises. All points are addressed in our Galvez Guarantee. So we scream this from the rooftops (figuratively speaking). You’ll see lots of pictures of our staff, including my own kids (who spend time at the agency), our office cat, and community service participation. We ask customers to include the reasons they do business with us and how we make the insurance process easier for them in their testimonials. Our marketing helps reinforce and communicate our brand. And best of all, when you have an established and clear brand, it makes all your marketing that much easier to create and promote. When you brand your insurance agency, you can establish the following:

You get the ultimate choice to scream from the rooftops who you are, what you, how what you do is better than the competition, and why people should choose you. You get to articulate once and for all, the soul of your business. And in an industry that is overrun with commoditization, isn’t it refreshing to have a way to fight back and perhaps even have some fun at the same time? So go on, tell your story. Your agency’s success depends on it. |

Archives

April 2023

Categories |

Home | Terms and Conditions | Earnings Disclaimer | Privacy Policy | Contact Us

Copyright© 2023 - Insurance Soup, LLC

Copyright© 2023 - Insurance Soup, LLC

RSS Feed

RSS Feed