|

One of the hardest things to do is scale your business. We're all able to build successful businesses that reach the limits of our own personal capacity. The problem most find is in scaling. And the reason so many Agents struggle to scale is because THEY are the reason for their success currently and to SCALE they need more of THEM in the office, but they do not HIRE more of them.

They do not hire the fire-in-their-belly-entrepreneurially-minded go getter. They hire people looking for jobs. They hire people with limited skill sets. They hire people with limited education. They hire people with limited ambition and drive. And Agencies quickly learn that 1 plus 1 does not equal 2. 1+1 may = 1.5. It may even only mean 1.25. Training and supervising also pulls the rockstar away from the stage they performed so well on to build that $1.5-2M Agency. Scaling requires systems and processes. Scaling can not rely solely on the current talent in your office. Scaling often will mean doing things completely different than what got you to the point you are at now. And that is where many Agencies get caught up. The confusion of "Why isn't what has always worked, working anymore?" And if you are not willing to systemize, if you are not willing to process, if you are not willing to create a culture where no one is more important than the next... and if you are not ready to be an ongoing and eager student, you will rise to whatever level of success you attain... and level off. And THAT is the exact point I see so many Agents who were ONCE super ambitious, settle into the idea that "This is the size my Agency will be." Now for many, thats fine. I was surprised a number of years ago by how many people are looking to just earn $X and maintain a book. I swore we were all trying to take over the world. The truth is, some of us are not. But if YOU are and you are stalling out, consider why. Are you as efficient as you can be? Is everyone in the office? Are you delivering a consistent delivery regardless of the day of the week, time of day, and staff member helping? Are you keeping up with the trends and evolution of the industry and business? The dinosaurs winding down the Agency they launched in 1977 will tell you they made adjustments along the way and petered out when they stopped. Why arent you? Stop relying on luck and talent so heavily and begin working on installing scalable systems that anyone can fit into. You will write more premium, help more families, and never be held hostage to that asshole employee that writes 3x more than everyone else. Your clients, wallet, family, employees, and Agency will thank you.

0 Comments

The 65 and over community is an enormous market for the insurance industry. Not only are lots of "seniors" reaping the benefits of their carefully planned finances, but they also tend to invest in things like second homes, boats and RVs meant to be enjoyed during retirement that need insuring. This means that getting in front of them in the right way can be a huge game-changer for you and your agency.

Back in the day, prospects over the age of 65 could be reached via local TV ads and radio spots, or even word-of-mouth referrals. But these days, with social media to thank, there are more ways than ever to connect with this audience because... you guessed it... seniors are on social media now! They're gaming on their iPads and tablets. They're streaming television. They're more digitally savvy than most people know. Check out these basics when you're looking to connect with them: MAKE CONTENT THAT HITS THE MARK It doesn't matter what kind of content you're putting out, the most important thing you can do is make it simple, to the point, and be sure it's appealing to clients over the age of 65. Make yourself familiar to them by sharing images of your office, yourself, and your staff. Showcase the products you offer, explain what they can do for them specifically and then explain exactly why your products are better for them than your competitors. CREATE A CAMPAIGN THAT MAKES SENSE Whether you're directing your audience to your Facebook page or your website, you want to be sure that everything is as clearly explained and easy to navigate as possible. Take time to ensure that your social media handles make sense and align seamlessly with your company name and that information on your website is not overly complicated. Also, be sure that any creative aspects of your campaign and any imagery it includes appeals to the proper age group. GET IN FRONT OF THEM The next, and trickiest, aspect of marketing to seniors is where to find them and how to connect with them. Your best bet for starting out online, if you choose to go that way, is FACEBOOK. Twitter and Instagram don't hold the same allure for the 65 and over community, and luckily for agents, Facebook is very insight-friendly when it comes to researching stats for ad campaigns. You'll be able to find the best times of day to reach your audience as well what kind of content is getting their attention and scooping up the most engagement. TALK ABOUT WHAT MATTERS TO YOU AND YOUR AGENCY Unlike some of the younger markets you try to reach, the older crowd is going to be more interested in what you stand for so this is an opportunity to shout it out, loud and proud. Talk about what your agency does in the community or any groups and organizations that you support. By showing your audience that your agency likes to give back to the people they work with and work for, you're going to build a certain element of trust. Keeping in mind that seniors are a special audience for your agency and that they require certain modes of marketing content and modes of delivery will make a big difference in your efforts to reach them. Follow these few tips and see what works best for your agency. Best of luck! This post originally ran on QuoteWizard.

Much like the insurance industry, technology has gone through a swath of changes over the years. “There’s an app for that” is a common phrase you might hear bandied about, but it’s a phrase that’s becoming true for nearly every aspect of life, be it personal or professional. There are 11 insurance agent apps in particular that you owe it to yourself to have readily available on your phone, tablet or laptop while you’re on the go and out in the field taking care of your customers and clients. 1. Evernote You might already have a note-taking app, but do you have one that lets you link photos to your notes and even record voice memos? Evernote has you covered with all three features so that your notes are more detailed, creative and expansive. This combination is a great way to capture and remember notes and moments of insurance inspiration as they come to you. Even better is the fact that the app makes note of your location in case it’s essential to your “eureka” moment. 2. Google Drive While Microsoft might have an iron grip on the office suite department, Google offers a viable, powerful and convenient alternative that works both on and offline. Best of all, it’s free, unlike most Microsoft Office products. With Drive, you can churn out spreadsheets, word documents and presentations for your clients. One unique feature of the cloud storage system is that you can share your creations with other people and give them the ability to make edits of their own, something that can come in handy if everyone isn’t able to be in the same place at the same time, which is common in the insurance industry. 3. FullContact Card Reader If you’re a minimalist, or someone who doesn’t have room for a deck of business cards, FullContact is the perfect app for you. The service allows you to scan business cards and store the information on your phone so you don’t have to worry about keeping (or losing) the card. One great feature of the app is that it’s checked for accuracy by a human being before it’s stored on your phone, ensuring that letters and numbers printed with a flourish are properly transcribed. One notable insurance marketing feature of the app is that you can gain specific insights on your contacts, such as affinities and interests. 4. CamScanner Taking business card scanning capabilities one step further, CamScanner is a free-to-use app that lets you scan claims forms, contracts and other documents with your phone and store them in a cloud. Once you’ve snapped an image of the document, you can magnify it, edit it and send it to all necessary parties. Like most apps that operate on a cloud, you can use CamScanner on your phone, tablet, and computer. 5. Expensify Sometimes the insurance business takes you a bit further than your usual jurisdiction. Agents who are on the road (or in the air) on the company’s dime now have an easy way to keep up with expenses, receipts and the like to make it easy for their employer to see how much they spent and where they spent it. With Expensify you can take pictures of your receipts while the app fills in the blanks and makes expense reports for your company so there’s one less thing to do when you get back. If you’ll be driving, the app can keep track of your mileage. 6. Uber/Lyft Speaking of going on the road for business, Uber and Lyft are taxi alternatives for those times where you don’t have access to a rental car for whatever reason. The apps let you hail a driver to your location through GPS, and you can pay as well as tip with card information stored in the app rather than worry about carrying cash. While both apps operate similarly, you might develop a preference for one over the other, or you might hail a Lyft when an Uber isn’t available and vice versa. 7. DocuSign Now neither you nor your clients or customers have to worry about being in the same place at the same time to sign important documents. DocuSign allows you to send those documents to the necessary recipient so she or he can sign them electronically. This saves a great deal of time, allowing you to take care of claims and business in general faster. The app also gives you the ability to manage documents, send reminders and see if documents have been successfully signed. For your peace of mind, know that DocuSign uses top notch data encryption technology. 8. LinkedIn Whereas Facebook is a social media site for connecting with friends, old classmates and family members, LinkedIn is a social media alternative geared towards your professional side. Here is where you’ll give others a glimpse of your professional accomplishments, skills, education and the like. The service makes for a great and powerful networking tool as well as one of the best mobile apps for insurance agents. Imagine how many potential customers are available on the platform who need quality insurance policies from a talented agent like yourself. 9. ScanPages Much like CamScanner, ScanPages is a document scanning app that lets you use your smartphone camera to turn documents into PDF files. The app’s cutting edge image processing technology ensures any documents you scan are of the highest quality. One great thing about ScanPages is that it allows you to send your files to Google Drive, Dropbox, Evernote or to someone’s inbox. Currently, the free app is only available on the iPhone. 10. GoToMeeting For those times when emailing, text messaging and phone calls aren’t enough, GoToMeeting gives you the ability to attend and host meetings and web conferences. Not you don’t have to waste time or spend money meeting with clients, which means you can get more done in a short amount of time. GoToMeeting features end-to-end encryption; a custom URL for meetings; and can be used on phones, tablets and PCs. You can also share the view of your desktop for added convenience. 11. HootSuite If you’re fully hooked into the power of social media, you probably already have a solid idea of how tiring and overwhelming it can be to switch back and forth between Facebook, Twitter, LinkedIn and the like. To give your finger and nerves a much-needed break, HootSuite is an app that brings all your social media platforms and profiles into a single shared space where you can easily reign over your digital kingdom. If you use social media as part of your insurance marketing strategy, know that HootSuite compiles statistics reports so you can easily keep track of how well your marketing and advertising efforts are going. And there you have 11 of the best mobile apps for insurance agents. Try each of them individually as well as in tandem to see how well they complement each other. For instance, Expensify is a great way to keep track of business trips made while using Uber. While most of the above apps are free, some you’ll have to pay for to gain access to certain features, or if you want to use the app a specific number of times. In any case, these tools are sure to make your life better and your insurance business more efficient. Having successful conversations with prospects isn't always second nature for every agent. Lots of times, when you're calling leads, there are many things happening at once and it can be easy to miss a cue or forget to ask an important question. This is an important opportunity you don't want to fumble. This is your chance to show a potential customer that you're the agent they want to do business with.

Over the course of your conversation with a lead, you're likely going to be giving a lot of information to the person on the other end of the line. It can be easy to forget all of the right questions at the right time. B sure to take the time to likewise pause for a minute and pay attention to what the individual needs to say. This will allow you the opportunity to more readily comprehend what their identity is and what they are searching for. The following is a list of key data from the client that agents should be writing down throughout the course of the conversation: WHAT STANDS OUT ABOUT THIS CLIENT'S NEEDS? Be sure to make note of any interesting information that could be unique to that specific client. This info will help you craft a customized sales plan for that customer. What problems does the client have that you could help with? How can you restore some level of comfort by helping solve those problems? Delve in and get however much significant information as possible so that you can create the best plan for that lead. WHAT'S HOLDING THEM BACK? Listen for and write down any existing objections that your prospect may have. No matter what the advantages of your offer are, there will be a few things holding that lead back. You must get familiar with their reservations so that you can prepare to tackle these potential issues head-on. You don't want to miss a sale when the client's objection is something that can easily be managed. Offering solutions tells the lead that their issues are normal and that you have tended to them with different customers. ARE THEY READY TO BUY? You're going to want to identify early on how motivated your prospect is to purchase your product, as well as whether or not they're in the position to buy at that time. A few shoppers will reveal to you when they need to purchase. Others won't be as open with this detail. Observe hints during your discussion. When working shared leads, attempt to get the reason behind the lead's interest in your offer before you get off the telephone but be sure to make it subtle. Attempting to hurry the sales cycle along can appear to be pushy and have an adverse consequence. WHAT DO YOU NEED TO RESEARCH FOR THEM? You. may run into a question or concern from a lead that you don't know the answer to offhand. This may seem like a problem, but it's actually a great opportunity for you to make contact with the client again. Be sure to let the client know that you're going to look into their concern and that you'll be getting back in touch with them with all of the relevant info as soon as possible. You never need to leave a potential purchaser hanging. All things being equal, record what you need to discover and afterward start gathering the data so you can get back in touch a second time. We all know that first impressions are of the utmost importance, especially when it comes to sales in an industry where trust is key. By recording these important details during each lead call you make, you're likely to hit and resolve all the most pressing pain points for your prospect. Happy dialing! CJ Hutsenpiller, co-founder of The Collective and owner of Tacobot, took to Facebook recently to describe part of the motivation behind creating a space for agents to come together in order to help one another. His thoughts below offer a no-holds-barred type of insight into the current state of agency across the country. If you agree with CJ and feel that you need a community of agents to help raise you to the next level, The Collective is waiting for you.

"We're under attack. This is why we created The Collective Agency Council. Some of us are aware of it. Some of us are not. But blissful ignorance will not stop this from coming. Direct to consumer insurance carriers want to tell the world an insurance agent is not valuable. They want to portray a message that insurance is easy - so easy in fact - the consumer can handle it themselves using slickly designed websites and apps. They want to shift the focus to price and away from having conversations about coverage. They want us, The Collective of local insurance agents out of the way. All of us. From California to the Carolinas. By ourselves, we are vulnerable. We are weak. We don’t have billion dollar marketing budgets. We don’t have call centers of agents selling & servicing insurance 24/7. We can’t leverage all the technology they have. We stand no chance against their attacks alone. We may barricade ourselves in our small towns and pretend things are going well - we may even be a rock in the center of our communities. But, he who moves a mountain begins by carrying away small stones first. It may not be today. It may not be tomorrow - but eventually - they will pick off the lone wolves - one by one. Buy them. Break them. Overtake them. They care not which. However, there is strength in numbers. There is strength in The Collective of power & knowledge. We can fight them. We can take the fight to them and beat them at their own game. We have the advantage - most of us just don't know it. Or worse - we don’t know how to use our advantage. Many of us don't know the weapons we wield are powerful when used properly. The local agent is the best way to purchase insurance. Period. The Collective can show you how to fight. The Collective can and will make you more powerful. Technology. Client experience. Automation. Management A to Z of all thing agency are covered by The Collective to make its members stronger. A rising tide lifts all ships. Hoist the colors high, folks. It's time for war. If you're ready to join the fight, get more info on The Collective here." Home ownership is no joke. It is part dream, part responsibility and part reward to take that giant step from renting to buying. You should always do your homework before buying a home to make sure it fits your needs and budget. The chances are that you'll want to make some improvements to your home at some point, whether you built it or bought it.

Many homeowners are choosing to take on DIY (do-it-yourself) projects due to the availability of so much online information. Prior to starting the remodeling project, there are several things you need to think about: Which room will be remodeled? What will the cost be? Can it be done in a reasonable amount of time? The equipment and materials you need can you store? It may turn out the DIY project needs to be handled by a professional after all, once you've answered all those questions. Selecting a professional contractor requires that the contractor be insured. Check with them if they have the appropriate insurance so that you are also protected. To make sure they have workers' compensation and general liability coverage, see their Certificate of Insurance. It's important to know if you are covered if your contractor is injured on the job or if the dishwasher starts leaking. The value of your home is crucial when determining how much coverage is required. The value of your home to your insurance policy will increase based on the improvement(s) you make, regardless of whether you are building an addition or just remodeling your kitchen. Increasing your insurance coverage also means boosting the amount you pay. Underinsured exposures can be expensive and it's risky to be short-changed if something goes wrong during construction or after the job is finished. You often end up with more complicated projects than you expected Be sure to do your research and speak to any agents you may know before pulling the trigger on a major DIY project or home improvement. The kinds of things you're going to want to know are as follows: - Will the remodel time be so long that you might have to temporarily relocate? Staying with friends or family isn't always an option and hotels can get very pricy when it comes to extended stay. - Where will you store all of the remodel components and equipment? Do you have room in a garage or would you need to purchase alternate storage? - Ask about the cost and risks involved with transporting costly materials yourself. Are you protected by your own auto policy in the case of an accident? - What if there's damage to your property during the remodel and you need to start from scratch? These are just some of the things for which your insurance agent can make sure you have the right coverage. The best thing that you can do is get ahead of the game by staying informed and being prepared for any and every. potential problem that can occur. This post originally ran on FriendlyAgent.com. Reading is my passion and every year I read or listen to at least 12-15 books which are mostly nonfiction. Based on my experience I thought of sharing some books which I really admire and may help you with your business. I understand most of us are not good readers and we may not have time to go through a 300-page book. But you can always listen to books using audible or other such services which will help you in completing book while traveling or doing regular chores. Every one especially insurance agent should be able to benefit from these books.If there is any other book which you feel should be added to this list then please leave a comment or send me an email. 1) Friendly Agent : Secrets behind building a multi-million dollar insurance agency – Avdhesh Saxena This book will provide you a playbook that you can use to start, build, and scale up an insurance agency. Do you know that starting an insurance agency is probably one of the best business ideas? Do you want to know . . .

You can either spend thousands of dollars in figuring out how to build a successful agency or use this book to get a roadmap for success. 2) Influence by Robert Cialdini This book talks about lot of behavioral tactics which sales people use to convince their prospective customers. Robert has drawn these strategies with his experience, conducting experiments and using research in behavioral psychology. Robert explains 6 principles or persuasion which will help you structure your sales strategy in such a way that it leads to better conversion. Every insurance agent should read this to close sales more effectively. After reading this book you will be able to better Influence not only your prospective customer but also your 2 year old toddler : 3) 4 hour work week – Tim Ferris This book was an eye opener for me and it breaks conventional wisdom where many feel that they should work 24/7 to achieve success. In this work of internet marketing there are many ways to make a fortune by just working 4 hrs a week. Tim has shared lot of experiences from different people he interviewed and has provided set of steps which will help you become more efficient. He talks about New Rich and lifestyle business which I never heard off. This book really changed my life and I am in this entrepreneurship journey due to this book. 4) The Millionaire Next Door: The Surprising Secrets of America’s Wealthy : Book by Thomas J. Stanley This books talks about mindset which one should have in order to accumulate wealth. It talks about people who are high earner but spend most of their money in supporting their lifestyle and don’t save much. It also provide example of people who with modest income are able to accumulate large wealth. It not only talks about accumulating wealth but also good practices which we can pass on to our kids which will help them in their life. 5) The Miracle Morning – Book by Hal Elrod This is again one of those life changing book. After reading this book I was able to join 5AM club and now I get so much done in morning. This book provides a framework which Hal calls SAVERS (Silence, Affirmation, Visualization, Exercise, Reading and Scribing) . This will help you not only in getting up early but setting your day in such a way that you have abundant energy to go through rest of the day. 6) How to Market on Instagram

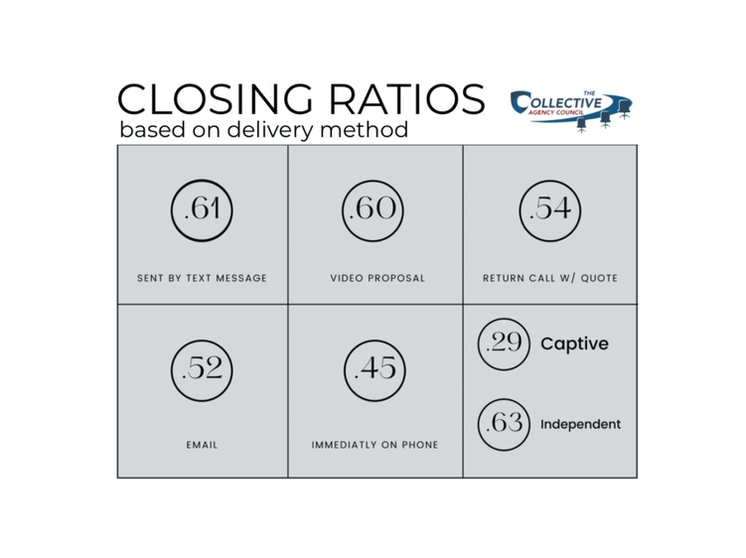

Are you using Instagram to grow your business? With more than 1 billion users engaging with Instagram every month this is one of the best platforms to find your customers. No followers? No problem. This book will show you step-by-step techniques to grow your Instagram following, create an engaged audience, and generate leads. So as you guys know, the Collective is using data being collected on our members to help lead all of us to smarter decisions and more intelligent conversation in Agency.

With hundreds and hundreds and hundreds of Agents submitting applications, we figured this was some data that you guys would find interesting. Now, obviously we are teasing this a little bit in here to educate you about the Collective - it's a new brand in here - so the first few weeks we will probably share a few tidbits of info that tell a story. But the Agents IN the Collective will have access to data like this constantly to help them gauge what to do and how to do it in their business. These are pretty tough to debate. It's the infoirmation gathered on peers all over the country. Not only is it data from Agents all over the country, we eliminated the top 5 outliers in the stats so the Agents trying to impress with BS figures don't skew the data. (Sorry Captive that says they close at 81%, you don't.) Information like this allows you to make smart and sharp decisions in your business. The conversation in this group is informative and good ideas are shared and you will always find some gold. The Collective is 1840s and 50s California. It's a gold rush. And the Agents back there are getting after it. Join us on an upcoming info session and learn why The Collective is better than going it alone in the industry. The Collective Agency Council - Gurus are Old News. Just tried that slogan for the first time. But we mean it. Good? Not good? We liked it. Register for an upcoming call here. You'll be shocked at what we're doing together. There is a great demand for qualified insurance agents in the U.S. Due to this demand, it is imperative that agents have the right tools to meet this growing need and assist many Americans in finding the right healthcare plan for them and their families. We'll discuss five essential tools every insurance agent should have in their back pocket.

#1 - A WEBSITE The best way for anyone to get started, no matter what industry they are in, is by building their own website. For insurance agents, your website is your number one way to market your services, build your brand awareness, and ultimately attract new customers. You can reach an incredibly wide audience by posting yourself online and casting a much wider net than you would have been able to otherwise. Whether you're a novice or highly experienced, there are dozens of online templates you can use if you'd like to create your own website. Several of them are free or extremely inexpensive to use. Check out Squarespace, Wordpress or Wix if you're looking for templates to use! #2 - A TOOL FOR CROSS-CHANNEL COMMUNICATION The next step after getting your website and CRM up and running is to download some communication software. Keeping in touch with leads and customers means communicating in their existing social networks. In the current age, this includes emails, text messages, social media, and many more. In an environment where there are so many platforms to manage, making use of cross-channel communication tools allows you to integrate all of these forms of communication into one platform. With open enrollment bringing in new customers ready to sign up for a new policy in addition to existing customers looking to renew their existing plans, the fourth quarter is easily the busiest time of year for the insurance industry. Keep up to date with your overflowing inbox using cross-channel communication tools, which will help you keep track of emails, messages, and comments. #3 - A WAY TO MANAGE ALL YOUR PASSWORDS Keep track of all the logins you use with a password manager as you implement all these different programs. You may be tempted to keep your passwords written on sticky notes on your desk or in a notebook, however this is neither secure nor practical. By using a password manager, you'll remember only one password, and all of your passwords for online accounts and profiles you've ever saved will always be readily accessible. #4 - SOFTWARE FOR OFFICE ORGANIZATION Getting everything you need for workplace organization from home is now increasingly important as more homes are becoming offices. There are dozens of tools that make traditional office work even easier, whether it's note-taking, document-signing, or list-making. #5 - A CRM Next, in order to organize and analyze your interactions with each person you speak with, you'll need a CRM program to store all the information about your leads and customers in one place. Your CRM will let you better manage, analyze, and personalize your interactions with your leads and customers. When it comes to closing any sale, information is key. If you call a lead that you spoke with about six months ago, you should have notes about that call saved. In order to avoid wasting time asking questions you've already asked, make sure there is a record of everything they've told you about their past experience with health insurance, any dependents they may have, and their long-term goals. Lastly, by using a CRM, you can instantly access client contact information and access a full report on everything you know about them. It makes customer service a much more pleasant experience for you and for your customers. Cloud-based tools will ensure all of your work will be immediately saved, backed up, and accessible whenever and wherever you need it - even if your computer crashes or you have a power outage. There is increasing demand for insurance agents to help people find sound healthcare, so you should prepare to meet the need. By following the steps outlined in this article, you can stay organized, find new clients, and give your policyholders peace of mind knowing they have the right plan. As any of you who have been following along with the news of The Collective Agency Council know, the council was recently founded by agents-turned-gurus. Mike took a a few moments to tell you the story of how he met one special founder, Bradly Flowers. Check out Mike's story below!

"I want to share with all of you a story about my friend Bradley Flowers. Bradley and I met in I want to say 2016 right here in good ol Insurance Soup. He was a fresh faced kid in the industry with a LOT of ambition, potential, and energy. At that point in time, we hosted Career Agent Concepts sales calls 1 on 1. We were not doing webinars yet. Taylor Dobbie and I booked 6-8 individual calls a day and did our song and dance. And one day I got Bradley as a lead. We hopped on the phone and spoke once and he needed to think about it. Second time... he was interrupted and had to hop off. Third time... reschedule. Fourth time... needed to think about it. FIFTH TIME... I went into the FIFTH call ready to give Bradley a little talking to about time management and respecting other professionals. I was ready to tell him all about clients who bought without even GETTING on a call with us and if he needed to consult with ANYONE else that he was not behaving like a business owner. The truth was he was young and nervous about making an investment into something he hadn't read up on and did not FULLY understand. The truth was I was nervous that a still new and reputation-establishing CAC was letting a lollygagging prospect take up too much of MY time when I had so many other Agents waiting to get on calls. And somehow the universe aligned that day and Bradley joined CAC on that fifth call. I didnt even have to strong arm him or let him know what I was really thinking that morning. Upon entering the program I watched him feverishly go through the material. I watched him post ad after ad asking for feedback. I watched him take many of our ideas and tweak them a bit - often in very cool and creative ways. I started taking notice. This kid was working. Really putting in effort. I watched him get better and better. I watched him become a vocal leader in CAC. And then one day I heard about a little podcast he had gotten off the ground along with his partner Scott Howell. Maybe you've heard of it The Insurance Guys Podcast. It's only the largest and most downloaded podcast in the industry with almost 20k downloads on many months - far surpassing, even doubling and tripling the other "larger" podcast audiences in the industry. Then I started seeing the guy pop up with Gary V not once but multiple times. Then HE helped get US invited to Gary V's event to present and speak on panels. While AT that event, we went to dinner down in Miami with Brad Auerbach, head of Insurance for Facebook, due largely in part to an introduction from Bradley. I have watched him go on to be nominated for Agent of the Future. I don't remember if he won or not. I want to say he did. Maybe he'll prove me wrong in the comments section. I have watched him launch a program designed to edit Agent video content that has quietly helped a handful of Agents look better on camera than they ever would have looked on camera alone. I have watched him launch his own independent Agency. I have seen him launch a 2nd podcast. I have seen him develop into a tremendous content producer, industry thought leader, speaker, and Agent. And today.... Today I am proud to announce that this lollygagging, on-my-nerves, going-to-tell-him-off prospect of CAC from 2016... Who has developed into someone I personally look up to in some areas of this industry. Who has developed into a hell of an entrepreneur. Who has developed into someone the INDUSTRY by and large embraces, follows, knows, likes, and trusts. Who has developed into a HELL of a friend.... is on his way to becoming an OWNER in The Collective Agency Council. We are super pumped with this addition to ownership at CAC. Our relationship and friendship with Bradley runs deep and his value, reach, and influence in this industry is tremendous. Bradley is going to be leading conversations around content production and Agency culture inside the Collective Agency Council. We couldn't be more excited about making it official. Congratulate Bradley Flowers with us as he takes on a new role within the industry and helps even more Agents than he already is, as an owner and mentor inside The Collective Agency Council. |

Archives

April 2023

Categories |

Home | Terms and Conditions | Earnings Disclaimer | Privacy Policy | Contact Us

Copyright© 2023 - Insurance Soup, LLC

Copyright© 2023 - Insurance Soup, LLC

RSS Feed

RSS Feed