American recreational marijuana use has doubled in the last 10 years, according to a new study from Jama Psychiatry, as reported by CNN. Considering that 23 states allow medical marijuana use and four of those states permit recreational use, maybe that increase isn't as surprising as the study's authors would have you believe.

Any way you cut it, attitudes toward pot are changing, and the laws of the land are following suit. And that shift has some implications for the business insurance world, too.

1. Pot and product liability

So here's a first for the marijuana industry: LA Times reports that Brandan Flores, a medicinal pot user, is suing the Colorado grower LivWell Inc. for using the fungicide Eagle 20 on its pot products. The report states the fungicide contains myclobutanil, a nasty little chemical that produces hydrogen cyanide gas when burned – not ideal for those toking up.

This product liability case brings up a bevy of insurance issues: will insurance cover the lawsuit? And if so, what policy?

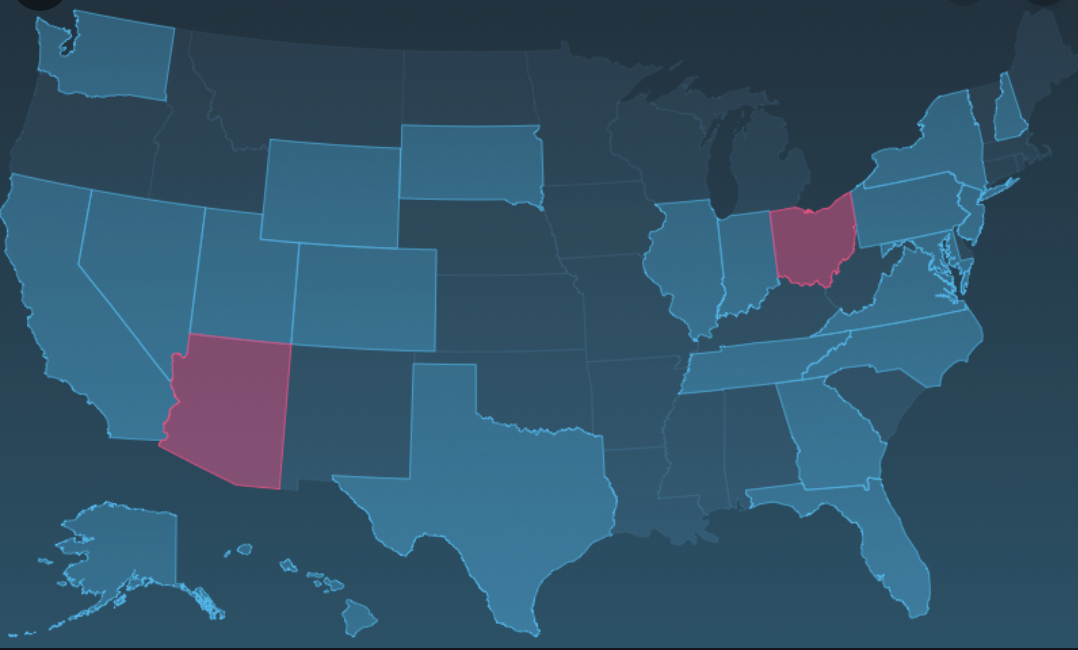

Insurers have had their eye on the pot industry for a while, but they've been slow to warm up to legal recreational marijuana. However, in states where recreational pot use is legal, it is possible to find specialized insurance for pot shops and growers. In fact, Insurance Journal reports that product liability insurance is required for all recreational operations in Washington and Colorado.

Product liability insurance, typically part of a general liability insurance policy, can address lawsuits over defective goods that harm customers. It may help pay for:

- Legal defense costs

- Settlements or judgments

- Other court expenses

If you work in the legal marijuana industry, always ask your agent about your coverage to make sure it meets your state's insurance requirements.

2. High risk in the office

Claims Journal reports that about 20 percent of surveyed small businesses are cool with their workers using medicinal marijuana at work, and 42 percent don't have a written policy that prohibits employees from being under the influence of marijuana at work.

But if your employees are allowed to use medical marijuana and are high at work, they could injure themselves. Workers' compensation insurance typically doesn't cover medical expenses for injuries that happen while an employee is under the influence, but that application gets tricky when medication is involved. As a general rule, if medicinal drug use was the proximate cause of an on-the-job injury, workers' comp benefits may not apply, according to a report by Business Insurance.

Whether or not your business allows employees to use marijuana in a medicinal capacity at work, be sure your company policy makes employees aware their use might affect their workers' comp benefits.

But what about weed used to treat occupational injuries? Does workers' comp cover that? Property Casualty 360 notes that most states require workers' compensation to cover treatment that is:

- Reasonable

- Necessary

- Effective

It reports that most insurance companies currently don't think medical marijuana is an effective treatment because it's not FDA-approved. However, that may not be true in all cases. For instance, pot used to stimulate an employee's appetite if they have work-related cancer might be a necessary part of treatment and covered by workers' comp. However, case law is still ironing out those details.

3. Stone(d) cold cyber liability

The pot industry has considerable cyber liability exposure, especially for medical marijuana dispensaries that follow a "wellness center" model. According to the Colorado Health Care Law Blog, these centers likely store patients’ protected health information (PHI) rather than simply checking their medical marijuana cards, so they can be held liable for HIPAA fines if patient-customer information is stolen or exposed.

Cyber liability insurance could be a smart investment for these businesses because it may cover the cost of:

- Notifying breached customers

- Paying for credit monitoring expenses

- Investigating the breach

- Rebuilding the business's reputation through PR measures

Some policies offer coverage for regulatory fines that follow a breach, too, but that depends on the provider. Again, ask your insurance agent for the whole scoop on your policy so you know what it does and doesn't address.

.png?width=180&height=65&name=Untitled%20design%20(29).png)